refinance transfer taxes new york

Currently 28 states allow for the transfer or assignment of delinquent real estate tax liens to the private sector according to the National Tax Lien Association a. The state of New Jersey requires you to pay taxes if you are a resident or nonresident that receives income from a New Jersey source.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Transfer tax differs across the US.

. It ranks 16 out of 50 states for the average closing costs before taxes. The APR will be between 599 and 999 for first liens and 699 and 1299 for second liens based on loan amount and a review of credit-worthiness including income and property information at the time of application. Holds real estate brokerage licenses in multiple provinces.

Should an owner fall behind on their property taxes their property will be liened. In the 2020 trial in New York Weinstein was convicted of one count of third degree rape and two charges of commuting a sexual act in the first degree and was acquitted of. This is the tax paid when the title passes from.

New York State transfer tax. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. For example Colorado has a transfer tax rate of 001 while people in Pittsburgh have to deal with a 4 rate.

How Wire Transfers Work. Properties of up to 500000. Pickup or payoff fee.

Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. Property taxes watersewer etc in which case you get payment of all arrears. Additionally if you live in one of the five boroughs youll.

This marginal tax rate means that. For example the average property tax bill for a single-family home in New Jersey was more than 9700 in 2021 while Alabama homeowners paid an. 442-H New York Standard Operating Procedures New York Fair Housing Notice TREC.

Taxes and Insurance Excluded. What to know about buying a condo or co-op in Florida Condos. New York State Homeowner Assistance Fund Up to 50k per Household Launches 132021.

To refinance the student can take out a new debt to pay off their parents existing PLUS loan. New York City transfer tax. Youll receive varying levels of death benefits loans accidental disability benefits for injuries and vesting long-term.

She is a vice president at BMO Harris Wealth management and a CFP. New York State equalization fee. Floridas closing costs are relatively high.

If no resale transfer or refinance occurs within five years and the. The lowest APRs are available to borrowers requesting at least 80000 for second liens or 200001 for first liens with the best credit and other factors. There are some strategies that can help manage or reduce the taxes owed on a year-end bonus howeverSome of these require donating to charity or making a contribution to a retirement or health savings account.

Julie Garber is an estate planning and taxes expert with over 25 years of experience as a lawyer and trust officer. If you pay either type of property tax claiming. While pensions and money for retirement are the main reasons that certain individuals become public employees there are many other benefits to belonging to one of New Yorks retirement systems.

Florida Maryland Michigan New York New Jersey. This allows investors to purchase tax deeds or certificates by paying the tax debt. How real estate transfer taxes differ from other taxes.

Year-end bonuses are subject to taxation just like any income received from an employer. Thats where the phrase wire transfer comes from. Refinances or transfers ownership of the home within five years of receiving the funds.

Rhode Island Student Loan Authority or RISLA is a Rhode Island-based nonprofit that refinances loans for customers across the country. On top of sales tax hovering near 9 New York charges state income taxes that can tally up to an expensive percentage of your paycheck. Unfortunately for those moving from almost any other state in the US New York will seem mighty expensive.

For a rate-and-term refinance the equity requirement will vary by lender but youll most likely need to continue paying PMI even after a. These days wire transfers involve the electronic movement of funds between different banks and credit unionsSince the term wire transfer is essentially a catch-all phrase it may also refer to the wiring of money. Buyers and sellers in DC New York and California have to fork over the most money while Missouri Nebraska and Iowa have the lowest closing costs.

After some time if the owner continues to not pay the property will be put up for a tax deed sale. The median home value among people age 60 and older is just 208500. Miscellaneous condominium fees.

What is the real estate transfer tax rate in New York. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. If you make 70000 a year living in the region of New York USA you will be taxed 12312.

Types of Retirement Systems in New York. Your average tax rate is 1198 and your marginal tax rate is 22. It stands apart for its income-based repayment program.

The newly refinanced debt would be in the students name and the student would make payments to. In New York State. Local Economic Factors in New York.

If you pay taxes on your personal property and real estate that you own you payments may be deductible from your federal income tax bill. Back in the day wire transfers happened through telegraph wires. Get ahead of anticipated rate hikes in 2022 and lock in a new refinance rate now.

Property taxes are collected at the county level. Some states such as North Dakota and New Mexico have no transfer tax at all. Countdown to Fed day.

Julie has been quoted in The New York Times the New York Post Consumer Reports Insurance News Net Magazine and many other publications. Located 90 miles from New York City and 60 miles from Philadelphia Allentown has lower housing costs than both larger cities. A mortgage in itself is not a debt it is the lenders security for a debt.

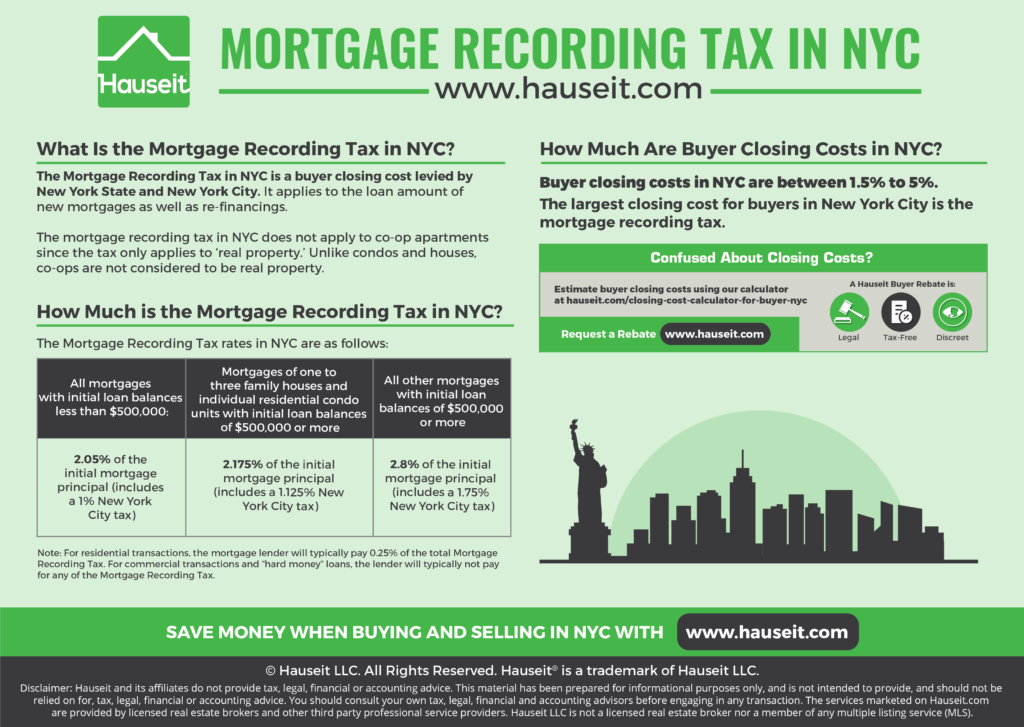

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Refinancing Your House How A Cema Mortgage Can Help

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Real Estate Transfer Taxes In New York Smartasset

Real Estate Transfer Taxes In New York Smartasset

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Mortgage Recording Tax Guide 2022 Propertyclub

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Heritus Mortgage Live Transfers Mortgage Loan Company Mortgage Loan Officer

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Remote Notarization Permitted In New York Benchmark Title Agency Llc

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Premium Vector Background Of Person Saving Money Saving Money Saving Habits Savings Calculator